|

There is an early pattern that often develops prior to a chronic disease diagnosis.

The more of these that stack up, the higher the risk. An advisor I spoke to yesterday had 4 of them but still thought of himself as someone who was healthy (just needing to lose a couple pounds). The reality of his situation is much more serious than losing a couple pounds. Any one of the issues below is a problem, but 3 or more is officially considered metabolic syndrome: 1) high triglycerides 2) blood sugar issues 3) a waist size > half your height 4) high blood pressure 5) low HDL Metabolic syndrome is the pathway to heart disease, diabetes, and cancer. This was an eye-opening moment for the advisor yesterday. Fortunately, there is something he can do about it. Step one is awareness of the reality of your situation. Step two is to take action to knock some of these off your plate. There are 5 pathways to health and 2 frameworks I teach to incorporate them into your life. These 5 pathways are: - blood sugar stabilization - metabolic flexibility - oxygen utilization - muscle & joint function - minimizing health traps & taxes When these get fixed, cravings go away, weight self-corrects, and peace and confidence show up in your health. What is your strategy for each? If you don’t know, consider joining my 6-week WellthPLAN workshop. It’s for financial professionals who have a successful practice and can shift a little of their focus to their health for 6 weeks to create their strategic wellness plan. People frequently wonder why I only work with financial planning professionals... Makes sense, everyone needs their health, right?

Let me ask you this question: Everyone (hopefully) has money. Why is a financial planner important? Yes, people have money, but not everyone has a clear, knowledgeable plan for their future. It's knowing how to cultivate your wealth that determines your financial future. How to protect it. How to grow it. How to prioritize its usage. And right there is the answer to the first question. I only work with financial planners because you get it. You get the philosophy. Everyone has a body, but not many people really know how to invest in their health the way they invest in their wealth. That's why we call it the WellthPLAN Workshop. In 6 weeks, we create a personalized plan for you to invest in your health as an asset. You might recognize some of the planning elements we focus on: What are YOUR goals? Is your priority to get back to triathletes? Or just to be able to play with your grandchildren? Your plan needs to reflect your goals. What are your current ASSETS AND LIABILITIES? We don't all start from the same place. We need to know where to start. What do we need to fix first? Where can we focus on good growth? How does this fit with your lifestyle? We don't want to draw up a plan that is unrealistic for your lifestyle. Whether its a hectic work calendar or heavy travel, we create a plan that fits with your lifestyle and makes healthy living realistic. At the end of 6 weeks, you walk away with a plan that is:

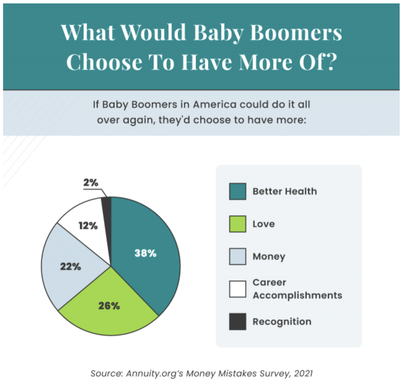

If you're interested in taking the next step, we start the next workshop in two weeks. Now's the time to hop on board and put your future first. Let me know if you'd like to chat about if this is the right fit for you. If you'd like to learn more about the program, you can see more here. If Baby Boomers could go back and make different choices, many would prioritize better health over more money in their retirement planning. Several studies suggest that it takes more than money to plan for a successful retirement. Good health is a large part of the equation, but often overlooked.

One of the studies was a survey conducted by the Nationwide Retirement Institute. It found that 76% of Baby Boomers would prioritize their health over a larger retirement fund. This is a significant shift from previous generations who saw money as the most important factor in retirement planning. You've probably heard of the Wheel of Life where you can self-assess eight areas of life. It's useful tool, and health is one of the eight, but it's a broad brush stroke over a complex topic. Health is created little-by-little with the fundamental habits you do day in and day out. So, a good measure of health is to measure your habits. So, I created the Wheel of Healthy Habits. |

AuthorI'm Stevyn... Categories

All

|

5/24/2023

0 Comments