|

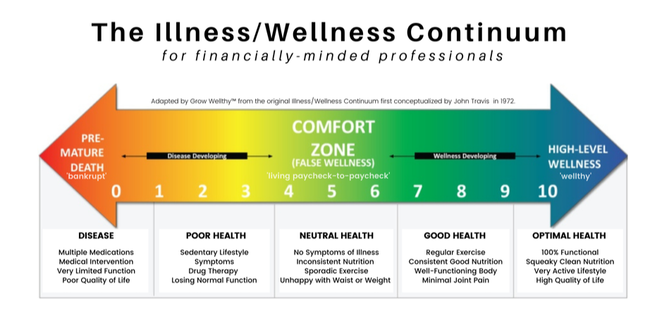

Here's an interesting discovery I made last week...81 percent of retirees say that good health is the #1 ingredient for a HAPPY retirement. Wait...good health? I thought it was money? $$$?? If that's true, why do most people spend so much time and effort investing in their 401K, but then neglect their health? I'm not saying that you shouldn't grow a financial nest egg for your golden years - but I am suggesting that good health is just as valuable to invest in. Unfortunately, that's simply not happening. We're taught to put money in our retirement accounts as soon as we start working. Our employers do 401k matches to encourage retirement prep. It's considered "irresponsible" to not set money aside for when you will need it later in life. Yet, most people do very little throughout their lives to protect their health. Sure, there are fad diets and a cascade of medications that make promises of "health", but most of that is just an illusion. If you think about it, it's actually quite sad. Consider Mark. He was a successful financial advisor in St. Louis. He kept his nose to the grindstone for his entire career and accumulated a considerable nest egg. He was smart with his money, investing it in all the right places. And he wasn't frivolous with his spending. Great job, right? Yes. Until he suffered a heart attack. It happened within the first year of his early retirement at the age of 55. Suddenly, the money didn't matter as much. In an instant, his health became his #1 priority. And his money was now funding his sick care...important, but not exactly the life he had envisioned. I don't want you to end up in this place. The financial industry is finally starting to realize that building a financial nest egg is only HALF of the retirement equation. Having all the money in the world can’t buy vibrant health. So a comprehensive, satisfying retirement plan must include BOTH health & wealth. That’s why our clients are saying “NO MORE” to putting their health on the back burner...and why they are starting to INVEST in their wellness. That’s why our clients are deciding to stop the downward spiral in their health...and finally taking CONTROL of their health trend. That’s why our clients are going from worrying about their risk of chronic disease...to finding the PEACE OF MIND that they are on the right track. That’s why our clients are enjoying FREEDOM as the pounds melt away and their confidence soars. In short, our clients are turning their health from a liability...into their most valuable ASSET. They're using a financial approach to wellness to create short term results with long term DIVIDENDS. But, best of all, they aren’t going to the gym or dieting. Instead, they are putting their habits & physiology to work for them so they can work smarter, not harder. Here are 5 questions to ask yourself (and your clients) when getting started on creating your health retirement plan: 1. Where is my health on this scale? Read the descriptions on the scale below and determine which number best fits your current health. Are you engaged in regular healthy habits and enjoying good health or are you starting to notice signs of poor health that are concerning to you? Wherever you are, it's possible to improve - but it's critical to protect the health you have now. There's this annoying little thing called "aging" that is kind of like inflation in the financial world. It's a part of life and it continues to erode your assets. In health, if you aren't actively working to mitigate the effects of aging, you will notice a quicker decline. Awareness of where you are is the first step. Then setting an intention to change is step two. 2. What does my daily low-level movement look like? When it comes to making changes in your habits - like exercise - you don't have to work out hard. Give yourself some grace here. "Go hard or go home" is a false concept for long term health. Frequent low-level activity feathered throughout your day is far more beneficial to preventing chronic disease and maintaining your weight. 3. How am I mananging my stress? Everyone has stress. It cannot be avoided. However, how you can learn how to recognize and dissolve your stress before it wreaks havoc on your health. Stress is a sneaky sabotager because it silently destroys your body's systems from the inside out. Taking 5 minutes to yourself several times a day to breathe, stretch, or sit in a massage chair isn't being lazy. It's boosting your resilience, immune function, and good hormones. 4. Am I getting enough nourishing food into my body? Switch your focus away from trying not to eat "bad" foods. Instead, seek out opportunities to eat as many of the healthiest foods you can find. This simple shift in thinking will add years of happiness to your life. By filling up on the good stuff, the less healthy foods are naturally crowded out of your diet...no will power needed. Check out an app called "The Daily Dozen" by NutritionFacts.org. It's a simple way to see if you are getting enough good stuff everyday. 5. How do I measure success? Success is what you define it as. It doesn't really matter what the measurement is as much as it matters that there is a measurement on your radar. Sure, there are universally accepted benchmarks like BMI, weight, and bloodwork numbers that you can try to adhere to, but the best measure is one that means something to you and that you will be able to keep an eye on yourself to know if your health is trending in the right direction. I have a few measurements that I rely on for myself and my clients, but if your's is clothing size or strength, or how you feel - that works as long as you are in tune with that measure and checking in on a regular basis. Keep Growing Wellthy Ask yourself these 5 questions on a regular basis and watch your habits improve. You will begin to build a robust health retirement plan that will continue to serve you many years from now. If you would like some help brainstorming answers to these questions for your unique situation, send me a message here. I also created a cheat sheet for advisors to use with their clients to open conversations about health and finances. It's option #3 on here. References:

Leave a Reply. |

AuthorI'm Stevyn... Categories

All

|

10/7/2020

0 Comments